A message from Robert Schilling

Frequently Asked Questions

An ESOP is an Employee Stock Ownership Plan that provides a company’s workforce with an ownership interest in the company.

- Employed as of December 31st, unless deceased or disabled.

- At least 21 years old.

- Paid for at least 1,000 hours of work (not including paid time off).

No. Only employees of the company are eligible to participate.

Early fall each year for the prior year.

Based upon your W-2 wages as the percentage of the total eligible W-2 wages of the company and your time in the plan.

- The plan is audited each year.

- The plan Trustee hires an independent valuation firm to provide a range of the value of the company.

- The Trustee then determines the value per share of each share of stock.

The ESOP is managed by a Trustee. The Trustee is legally obligated to protect the interests of the ESOP participants.

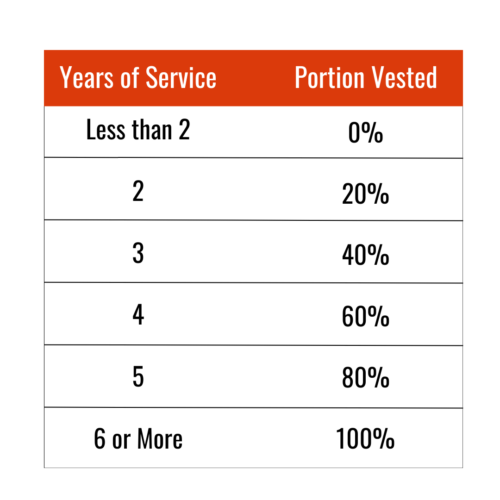

Vesting is the portion of your account that belongs to you and cannot be forfeited. Each year you work at Fraley and Schilling, you become more vested in your ESOP account. Vesting is measured from the day you start participating in the ESOP.

- Over time with the company.

- Age 65 and reach your fifth anniversary in the ESOP.

- Upon death or disabled.

- Employment terminated

- Normal Retirement (>65 years old and 5 years with 1,000 hours)

- Voluntarily Leave

- Terminated (let go)

- Disabled

- Death

For any other questions, click the link below to fill out a form. Your questions are important to us and will be answered shortly.

For a more detailed FAQ, click the link below.